Blog

Identity Verification Blog

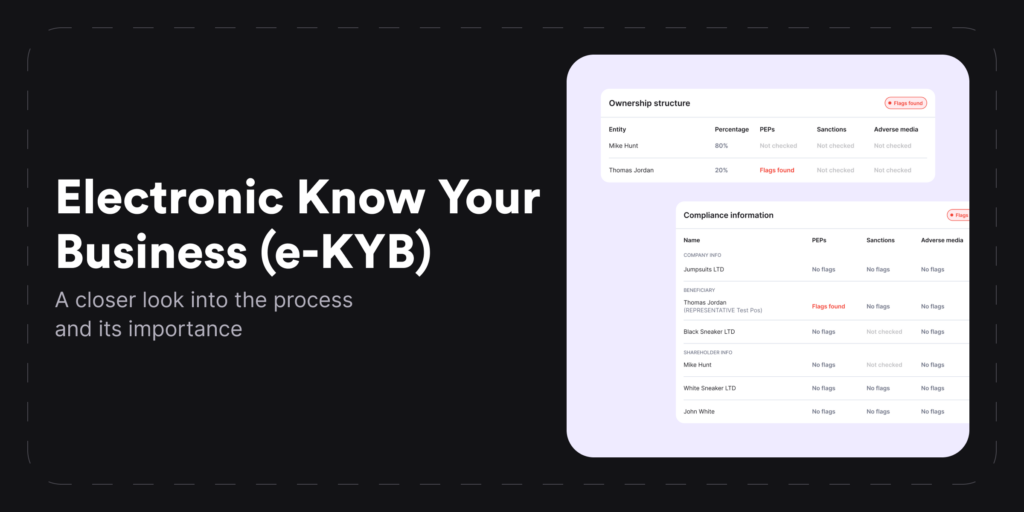

e-KYB Explained — A Comprehensive Business Verification Guide

Learn how to prevent partnering with illegitimate companies and build trusted business relationships easier with a streamlined approach to business verification — e-KYB.

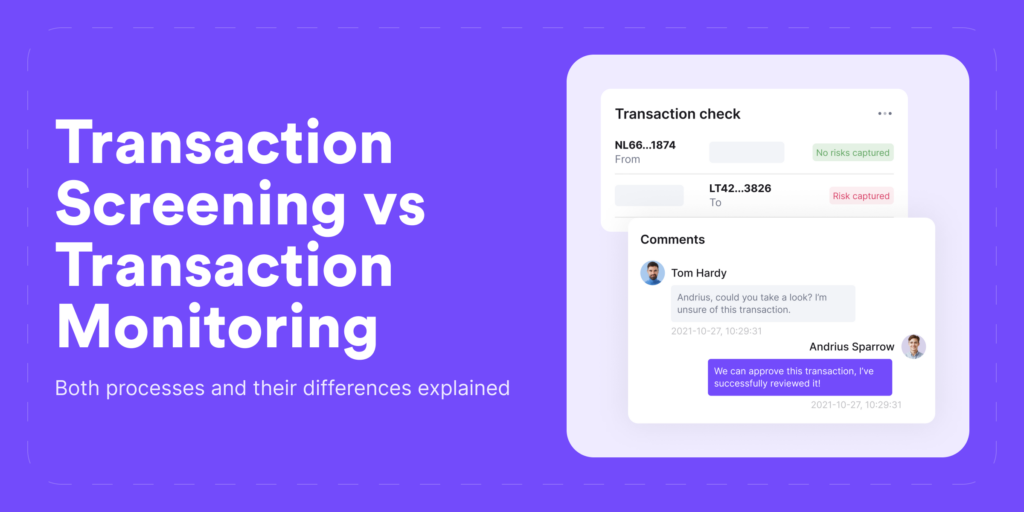

Transaction Screening vs Transaction Monitoring [AML Guide]

Explore the key differences between transaction screening and transaction monitoring processes, learn why they’re vital for AML compliance, and find out the best ways to manage emerging fraud risks.

March 19, 2024

An Overview of the Anti-Money Laundering Act of 2020 (AMLA)

A major milestone in AML compliance occurred with the passing of the Anti-Money Laundering Act of 2020 (AMLA), which perfectly reflects the expansion of US AML laws in recent times. Discover the key changes and their impact on today’s AML landscape.

March 15, 2024

Know Your Employee (KYE) Explained

You should know your customers, but what about your employees? We dive into the process of Know Your Employee (KYE), pinpointing the key challenges of identifying individuals and specific background checks that are vital before the hiring and onboarding stage.

Best KYB (Know Your Business) Software Providers of 2024

Explore the latest review of best KYB (Know Your Business) software providers and recommendations on where each of the service excels the best.

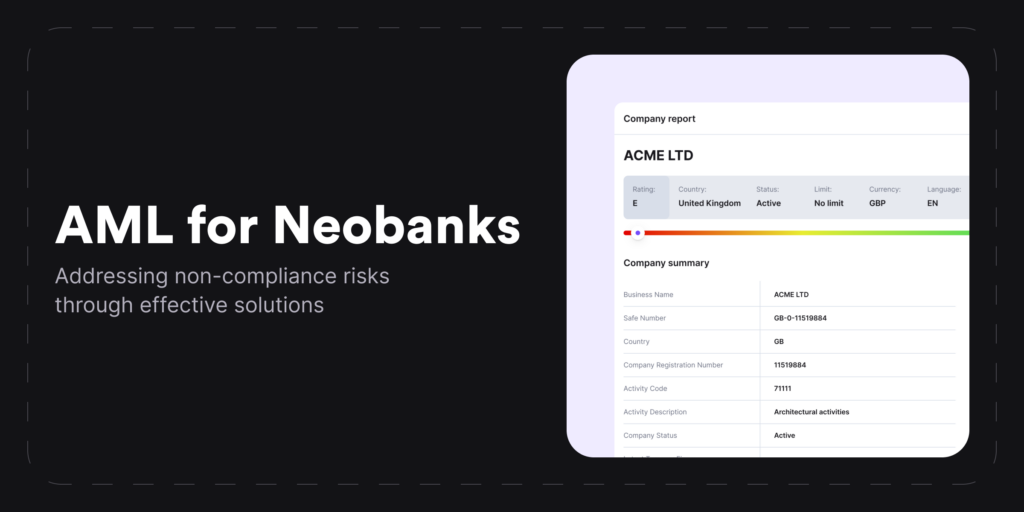

AML for Neobanks: Compliance Challenges and Solutions

Find out which qualities make up a neobank, how this new form of a bank differs from traditional financial institutions, if neobanks are obliged to stay in line with the same AML requirements and learn how they overcome their compliance challenges.

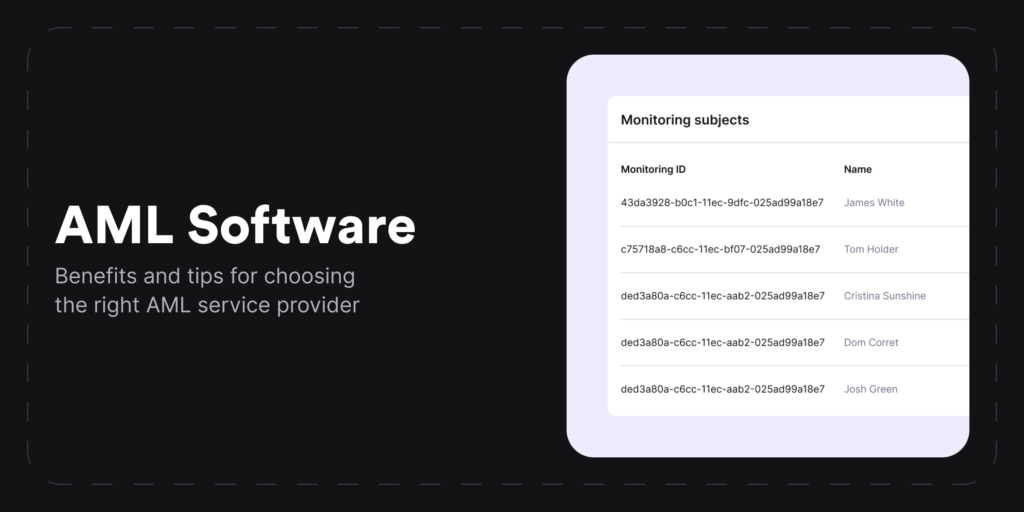

Anti-Money Laundering (AML) Software: Explanation, Features & More

Explore the world of anti-money laundering (AML) compliance, access insights on selecting the right AML software, identify what crucial features AML automation should have, and understand what AML procedures AI-powered solutions can actually automate.

KYB vs KYC — What is the Difference? [Explanation Guide]

KYB and KYC checks are vital for AML compliance, ensuring safety through verifying identities, reporting suspicious activities, and maintaining detailed financial records. Discover the distinctions between both processes and learn the essential steps helping businesses prevent financial crime.

February 23, 2024

Top 5 KYC Challenges and How You Can Overcome Them [In-Depth Explanation]

Learn the key reasons why companies struggle with KYC challenges. Find out how to build a proper identity verification process while keeping up with the regulatory compliance requirements and increasing customer demands — all while exploring real-life use case examples from various industries.

February 21, 2024

Transaction Monitoring Software in Fintech: How to Set it Up?

One of the most important parts of the Anti-Money Laundering (AML) compliance package is transaction monitoring — a thorough practice of tracking customer transactions. However, how does it actually work in the context of fintech, and how can businesses improve this process? We explain it all in this blog post.

February 14, 2024

AML Red Flags — Complete Breakdown

Did you know that the Financial Action Task Force (FATF) was created in 1989? Since then, they have set grounds for a more stable action plan against money laundering and terrorist financing. However, the level of complexity in financial crime is rising, and companies must be vigilant when it comes to different risks — or, as we call them — AML red flags.

February 7, 2024

Address Verification Explained

Access the most recent information on address verification, including use case examples, and learn the key methods for confirming whether the provided address data aligns with the information provided by another individual or business.

January 31, 2024

What is Ongoing Monitoring? [With Examples]

Dive in to find ongoing monitoring examples, what it takes to stay KYC/AML-compliant, as well as the challenges that arise when trying to build a proper ongoing monitoring process.