KYB/AML

Education about KYB (Know Your Business) and changes in AML

Transaction Screening vs Transaction Monitoring [AML Guide]

Explore the key differences between transaction screening and transaction monitoring processes, learn why they’re vital for AML compliance, and find out the best ways to manage emerging fraud risks.

AML for Neobanks: Compliance Challenges and Solutions

Find out which qualities make up a neobank, how this new form of a bank differs from traditional financial institutions, if neobanks are obliged to stay in line with the same AML requirements and learn how they overcome their compliance challenges.

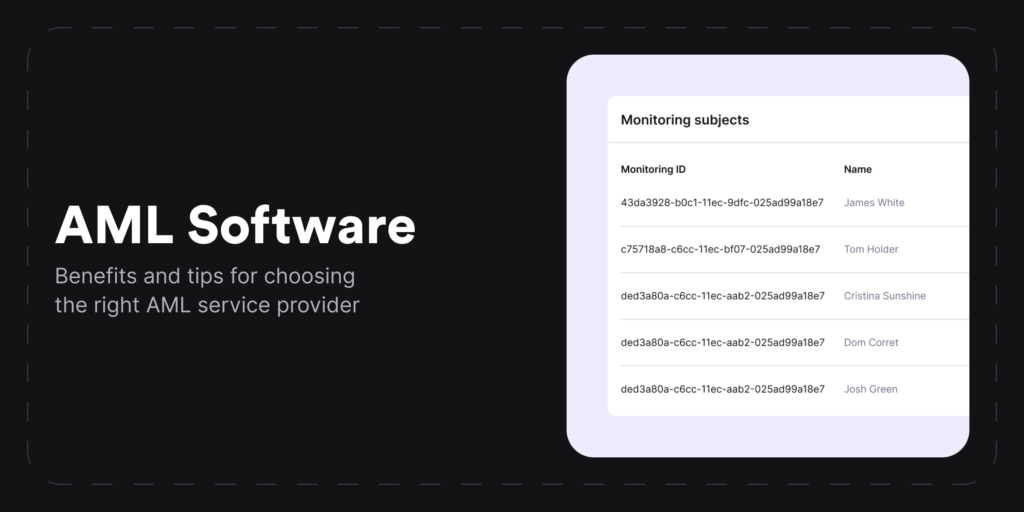

Anti-Money Laundering (AML) Software: Explanation, Features & More

Explore the world of anti-money laundering (AML) compliance, access insights on selecting the right AML software, identify what crucial features AML automation should have, and understand what AML procedures AI-powered solutions can actually automate.

KYB vs KYC — What is the Difference? [Explanation Guide]

KYB and KYC checks are vital for AML compliance, ensuring safety through verifying identities, reporting suspicious activities, and maintaining detailed financial records. Discover the distinctions between both processes and learn the essential steps helping businesses prevent financial crime.

AML Red Flags — Complete Breakdown

Did you know that the Financial Action Task Force (FATF) was created in 1989? Since then, they have set grounds for a more stable action plan against money laundering and terrorist financing. However, the level of complexity in financial crime is rising, and companies must be vigilant when it comes to different risks — or, as we call them — AML red flags.

Business Verification Solution in 2025 – Focusing on Automating Compliance Procedures

Check hands-on walkthrough on configuring custom rules to streamline your AML compliance processes while onboarding new companies.

Ultimate Beneficial Owner (UBO): Verification Guide

Any entity falling under Anti-Money Laundering and Anti-Terrorist Financing regulations must know the exact identity of the Ultimate Beneficial Owner (UBO) for all their business transactions. While this isn’t a new regulatory requirement, many organizations struggle to identify UBOs due to various challenges, including complex corporate structures or intentional efforts to hide the UBO status for the sake of financial crime, such as money laundering. Read more.

KYC vs AML: Key Differences in Compliance [Updated]

KYC, AML, CDD… Similar but very different compliance terms that people tend to confuse. While regulations vary across countries and different areas, nowadays, not only financial institutions but many other businesses need to know the differences between the mentioned components to maintain effective Anti-Money Laundering programs.

November 24, 2022

AML Regulations in the USA: Everything You Should Know as a Business Owner

Since 2002, more than 38 institutions in USA have reached settlements or pled guilty due to non-compliance with AML regulatory requirements and paid substantial fines in settlements.

October 4, 2022

AML Guidelines in the European Union. What Should Financial Companies Know When Applying Business Verification?

Over the past decade, the EU has been considering how to combat the potential illicit flows through banks and other financial institutions. It’s clear that stricter financial processes call for a more robust action plan from all financial players. This time, we’ll review the EU and its standards by providing all the necessary guidelines.

Know Your Business (KYB) Verification: What You Need to Know

Learn what Know Your Business, or KYB verification, is, focusing on the main compliance challenges in regulated, high-risk industries while learning about key automation solutions.

Screening and Ongoing Monitoring: Using AI Tools for AML Compliance

Are you wondering what tools and methods can detect and prevent vicious crimes, such as illegal earnings and money laundering? Will it be Customers’ AML Screening and Ongoing Monitoring? Keep reading to find out.

Why Know Your Business (KYB) is Crucial for Your Company

KYB, or Know Your Business verification, is crucial for onboarding and monitoring corporate clients. Learn how to onboard your partners, identify the individuals controlling the organization and help prevent money laundering.