The sharing economy has significantly changed how people do business and buy things/services. One of the primary reasons it is appealing to people is that it allows them to make money from little things, which is exceptionally important because we are all aware of the limited resources on the earth.

Besides this, the sharing economy opens up a lot of self-employment opportunities, embeds a sense of trust in the marketplace, and helps us reduce our carbon footprint to a great extent.

While the sharing economy solves many societal problems, it struggles with some challenges. Let’s discuss issues in the sharing economy industry and determine how identity verification can resolve them.

Before that, let’s explore the intricate topic of the sharing economy and learn how identity verification benefits this industry in modern times.

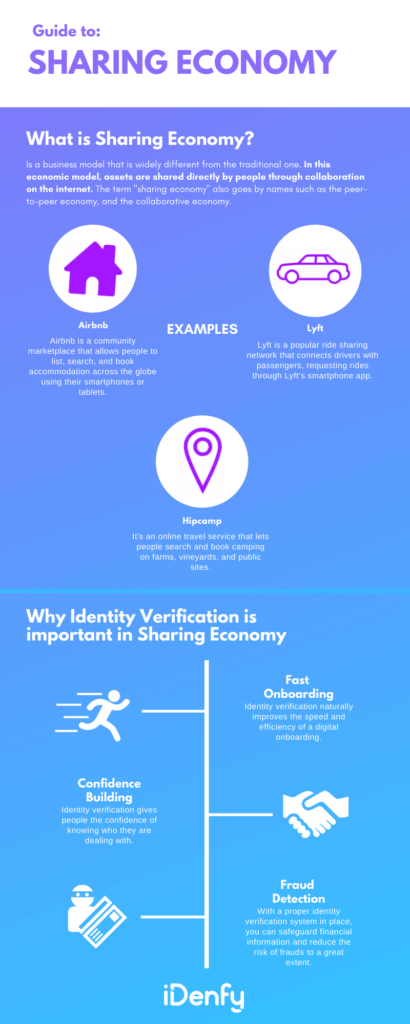

What is the Sharing Economy?

The sharing economy is a business model that is widely different from the traditional one. In this economic model, people share assets directly through collaboration on the Internet. These exchanges typically take place through digital platforms, often accessible via mobile devices or online.

The term “sharing economy” also goes by names such as the peer-to-peer economy and the collaborative economy. Its system is built on peer-to-peer (P2P) transactions, where individuals share access to various services and goods, ranging from accommodations to vehicles.

Sharing Economy Solutions

The most popular use cases in the sharing economy include these solutions:

- P2P lending

- Ridesharing

- Home Sharing

- Online marketplaces

- Crowdfunding

Some famous examples of companies involved in the sharing economy include:

Airbnb

Airbnb is a community marketplace allowing people to list, search, and book accommodations globally using smartphones or tablets. The company enables individuals to monetize their extra space and promote it to a target audience worldwide.

Lyft

Lyft is a popular ride-sharing network that connects drivers with passengers requesting rides through Lyft’s smartphone app. Riders can pay for the service through the app.

Hipcamp

It’s an online travel service that lets people search and book camping on farms, vineyards, and free sites. The service connects landowners with campers.

Turo

Turo is a peer-to-peer car-sharing marketplace that lets people rent vehicles from local car owners. Riders can pick up the car or ask its owner to deliver it to them.

The Importance of Identity Verification in the Sharing Economy

Sharing economy platforms and solutions are regulated, meaning that like banks, they must ensure a proper identity verification process as part of their Know Your Customer (KYC) obligations. Often, this is achieved through frictionless solutions like selfie verification or a combination of both paired with document verification.

So, for example, if a user wants to access a car on a vehicle rental app, they’ll most likely need to upload a photo of their government-issued ID document and a picture of their face. Then, the identity verification solution cross-checks data with reputable databases and approves or denies access to the car. This remote process also referred to as Electronic Know Your Customer (eKYC), replaced labor-intensive manual checks with remote facial recognition algorithms.

Another more straightforward way to approve such individuals at the onboarding stage is to implement driver’s license verification. In general, verifying users is crucial for establishing trust and security between a company and its clients.

The History of the Sharing Economy Sector

The sharing economy concept didn’t present itself in a year or two. That’s why it’s safe to say that it’s an evolution that took years to reach its current position. According to Forbes, the sharing economy sector is projected to reach $335 billion by 2025.

When eBay launched in 1995, the world saw a significant shift in how people buy merchandise and circulate them in the market. The company was one of the first facilitators of the sharing economy. They provided a worldwide online marketplace where anyone could buy or sell any product.

Although eBay is not viewed in the same light as other mainstream market-sharing services like Turo, Airbnb, and Lyft, it was the first to link buyers and sellers without any retailer in the middle.

With advancements in technology, more and more companies started becoming part of this fantastic industry. Today, almost every sector has a reputable name that contributes to the sharing economy.

Common Problems in the Sharing Economy that Emerge Without KYC

Undoubtedly, the shared economy industry is positively changing consumers’ lives. Today, millions of people are using services like Airbnb, Lyft, Fiverr, and the list goes on. However, it does not mean there is nothing wrong with the industry. For example, the sharing economy has faced regulatory challenges and legal scrutiny in various regions due to concerns about safety, taxation, and fair competition. Finding a balance between innovation and regulation remains an ongoing challenge.

Everything seemed a win-win situation for service providers and users in the sharing economy industry. Still, as the industry grew, some challenges started to appear.

Some common security issues include:

Trust Issues

The trust issue is quite common in the shared economy marketplaces. Whether you take the example of Airbnb or Lyft, service providers and service recipients both have to trust strangers. A driver needs to trust the passenger they are driving in and vice versa. Similarly, a traveler has to trust the landlord to provide them with a homestay.

So, the trust gap is the biggest challenge that most companies struggle with. Though the idea of sharing services is becoming acceptable and comfortable for both parties, it will take some time to die down completely.

Data Privacy

Sharing economy platforms collect and store a significant amount of personal data from users. Ensuring the privacy and security of this data is paramount to protect against data breaches and identity theft.

Payment Fraud

Fraudulent payment methods, chargebacks, and payment disputes are common challenges in the sharing economy. These issues can result in financial losses for both users and platform operators.

Identity Fraud

Since the sharing economy is entirely based on online communication, identification is another major challenge. Besides a few giant firms, most companies in the shared economy industry are not well-equipped to combat the growing risk of fraud.

According to a survey, 71.5% of sharing economy platform users verify their identities by providing their email ID only. This can lead to account takeover (ATO) fraud that can result in several adverse consequences for users, amplifying their vulnerability to various risks.

When someone gains unauthorized access to an account, they can potentially exploit it to access sensitive personal information. This, in turn, also opens the door to financial fraud, damage to the user’s reputation, and emotional distress.

The Lack of Identity Verification

Nowadays, fraudsters are misusing shared economy platforms to target people and commit fraud. Not only cyber attackers but sometimes also the people behind the platforms might turn against the users. In general, verifying the identity of users can be challenging, leading to concerns about the legitimacy of participants. This can result in fraudulent transactions, theft, and safety risks.

Therefore, it’s essential to have a proper identity verification solution in the shared economy industry.

ID Verification in the Context of Regulatory Compliance

Ensuring identity verification is a critical regulatory requirement for operating within the sharing economy. Failure to incorporate identity verification in the onboarding process can lead to substantial government-imposed penalties. That’s why identity verification regulations provide guidelines that may encompass methods such as live detection, face authentication, and biometrics to prevent fraudulent activities.

For instance, in the United States, Congress passed the Anti-Money Laundering Act of 2020, while the European Union introduced its ID verification law called AMLD6. These legislative measures underscore the importance of robust identity verification practices in the sharing economy and beyond.

The Key Benefits of Identity Verification in the Sharing Economy Industry

Identity verification can play a significant role in minimizing most of the issues of the sharing economy industry. Robust AI-powered ID verification solutions help companies operating in the sharing economy sector by helping establish a trustworthy and secure community, reduce the number of users who abandon the onboarding process, and prevent malicious users.

But that’s not all. In the following section, we discussed that trust and safety are some significant concerns of people associated with the sharing economy. Well, these problems can be kept at bay with proper implementation of identity verification.

Below are some benefits of utilizing identity verification for a sharing economy platform:

Fraud Detection

With a proper identity verification system in place, you can safeguard financial information and reduce the risk of fraud to a great extent. Using an advanced identity verification solution, you can rest assured that all the people joining your services are genuine and not involved in any illegal activities.

Confidence Building

Identity verification helps you verify the identities of your clients/customers and gives people the confidence to know who they are dealing with. With proper identity verification, the service recipient and service provider, both can trust each other easily.

Fast Onboarding

Identity verification also helps you with growing your business. When you use an advanced identity verification solution to validate your users, you naturally improve the speed and efficiency of digital onboarding.

KYC and AML Compliance

Identity verification is a crucial part of AML and KYC compliance. All online businesses involved in financial transactions must comply with such requirements that continue to evolve, forcing companies to adapt. Identity verification helps you ensure that you comply with these directives.

If you’re searching for an advanced identity verification solution for your sharing economy platform, you can rely on iDenfy. Since our identity verification solution is powered by machine learning, it can automatically check facial biometrics.

To learn more about our services, you may book a meeting.

This blog post was updated on the 28th of June, 2024, to reflect the latest insights.