Any platform that offers online services or items to purchase through electronic payment methods needs to know about payments compliance. This sort of handling of online transactions and electronic funds transfers increases the risk of crimes. For example, common threats include money laundering through online luxury item auctions, account takeovers on high-value online marketplaces, or unauthorized transactions using stolen identities, which are often possible using forged IDs or other fraudulent techniques.

With AI, which is now commonly used both for fraud prevention and fraud itself, businesses need to implement proper security methods that are effective, efficient, and user-friendly. Otherwise, they risk losing customers to competitors or, worse, paying huge non-compliance fines. To safeguard consumer data and maintain a fair and transparent payment ecosystem, regulators around the world have prepared a range of regulations or rules that all go into a standardized framework, also known as payments compliance.

We look into the key elements of payments compliance, mandatory processes like identity verification, payment provider rules, consumer protection laws, and other general fraud prevention measures that online platforms need to know.

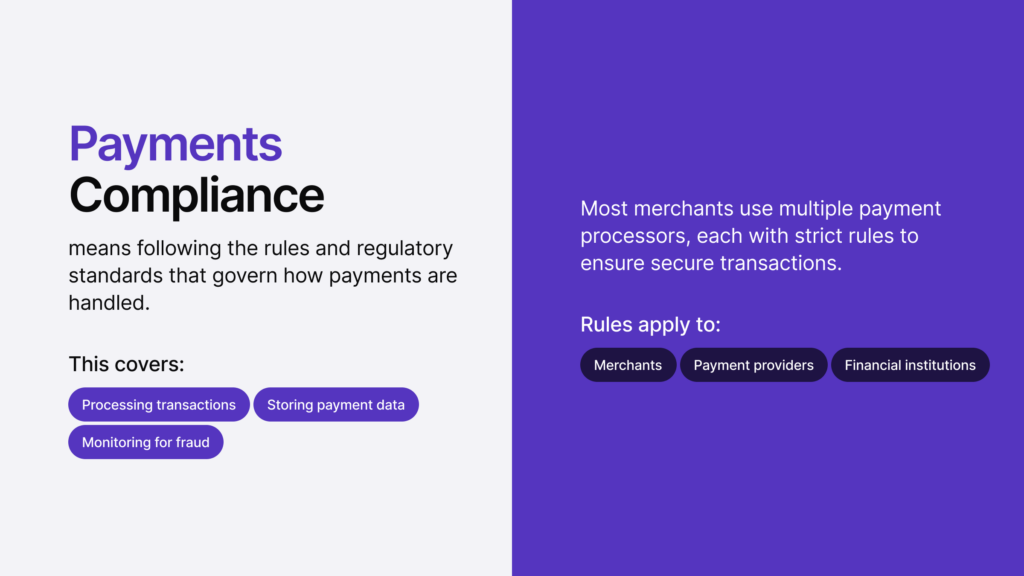

What is Payments Compliance?

Payments compliance is a set of policies and regulatory standards that businesses that accept electronic transfers or credit card payments need to implement to handle financial transactions compliantly. These specific rules help companies operate securely and legally while ensuring their customers’ data is protected. In practice, payments compliance involves establishing internal policies for handling transactions and protecting payment data.

Some examples of key standards that are a part of payments compliance include:

- Rules set by payment network operators (for example, Mastercard)

- Know Your Customer (KYC) and Know Your Business (KYB) regulations

- Anti-Money Laundering (AML) regulations

- Consumer protection laws (for example, the Federal Trade Commission Act)

- Data privacy regulations (for instance, the California Consumer Privacy Act (CCPA))

- The Payment Card Industry Data Security Standard (PCI DSS)

Ultimately, payments compliance mandates e-commerce platforms, fintech companies, online marketplaces, real estate agencies, and other regulated entities to stick to requirements regarding storing payment data, processing transactions, and ensuring ongoing monitoring for fraudulent activity.

The Main Areas of Payments Compliance

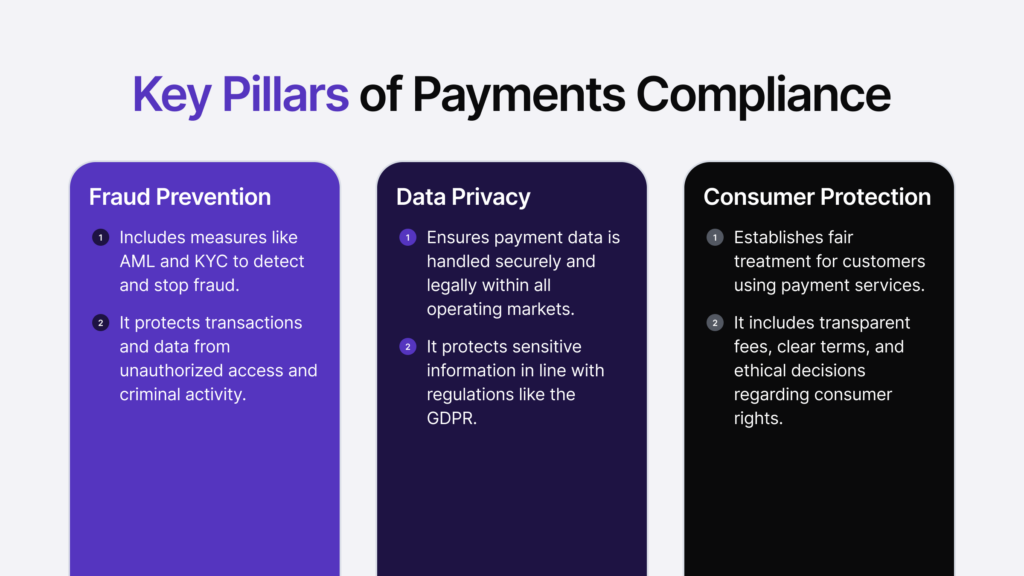

Payments compliance focuses on core factors that revolve around:

1. Fraud Prevention

Fraud prevention measures are regulatory standards that are designed to identify and prevent fraudulent activity. In the payments compliance context, these measures protect from all sorts of deceptive practices linked to financial transactions. For example, this could be unauthorized access. In general, the most well-known fraud prevention measures are Anti-Money Laundering (AML), Know Your Customer (KYC), and Know Your Business (KYB) protocols. AML measures consist of screening against various criminal databases, such as Interpol’s Most Wanted, or screening for adverse media using special keywords that would show an individual’s links to criminal activity.

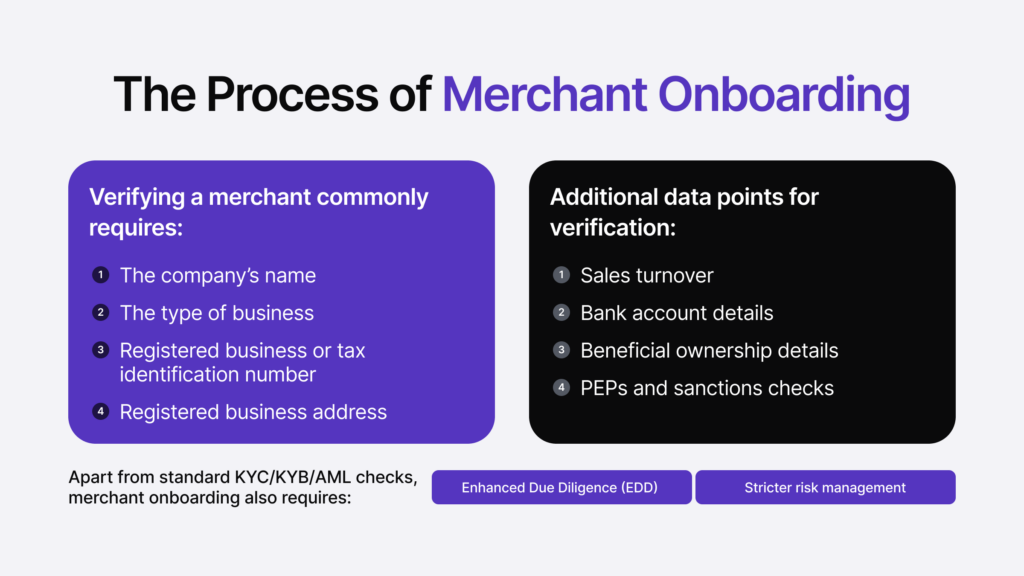

KYC or KYB compliance is designed to verify identities, both individual clients and corporate clients’ full checks about a company, often used when screening potential business partners or third-party vendors. There are other measures that go into fraud prevention, depending on the particular company and its use case. For example, certain industries that must comply with AML deal with specific issues, like iGaming platforms with multi-accounting and bonus abuse. As it’s relatively easy to create accounts these days, bad actors use any platforms they can milk money from.

For example, marketplaces are a common target for fraud, whether through selling counterfeit goods, hijacking user accounts, or listing items that don’t actually exist. That’s why many challenges can be solved with the first line of defence in the entity’s KYC/AML framework, which is identity verification and asking the user to upload their ID document before creating a new account on a certain platform or making a purchase. Failure to implement effective fraud prevention controls can lead to serious financial losses and regulatory penalties.

Related: What is Fraud Detection?

2. Data Privacy

When it comes to money and sensitive payment information, multiple layers of security need to be applied, starting from authentication and ending in encryption, all while aligning with various data protection regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA), depending on your jurisdiction. In practice, this means businesses need to clearly inform users about how their personal data will be used. Users must give explicit permission before their information can be collected or processed.

For businesses, implementing measures like two-factor authentication (2FA) also helps protect data and enhances payment security by adding an extra layer against account takeover (ATO) fraud. There are various methods for this, but some popular 2FA measures include a One-Time Password (OTP), which is a unique code that’s sent to the user’s device through a special authenticator app or SMS before they complete the transaction. A more advanced approach is a full or partial KYC verification flow (where either selfie or document verification is used along with 2FA). For example, the user might receive a Magic Link that redirects them to a biometric check, where their identity is verified using facial recognition technology to authenticate their physical traits.

3. Consumer Protection

Similar to how payments compliance focuses on protecting the business and the payment information, it also targets consumer rights by enforcing standards to maintain an ethical environment and prevent abusive practices on online platforms. This means that platforms need to have clear payment terms and fee disclosures, maintaining a fair treatment and adequate protection for all customers. Additional information, such as clarifying liability in case of unauthorized transactions or dispute procedures, must be disclosed as well.

Who Regulates Payments Compliance?

Payment compliance is regulated by different regulatory authorities, depending on the country or region. For example:

🌎 Global Standards

PCI SSC is responsible for the PCI Data Security Standard (PCI DSS), a global framework that protects the payments industry. It focuses on these main steps that companies must follow:

- Protecting cardholder data

- Maintaining a vulnerability management program

- Implementing strong access control measures

- Regularly monitoring and testing networks

- Maintaining an information security policy

All major credit card companies, such as American Express or Visa, adhere to this standard to secure the handling of cardholder data by merchants.

🇪🇺 Europe

Regulations like the Payment Services Directive 2 (PSD2) (which aims to create a more unified payment system) and 3D Secure 2.0 (3DS2) and Strong Customer Authentication (SCA) (which requires multi-factor authentication and identity verification) help ensure the security of the payments industry.

For example, PSD2 was enforced in 2018, and since then, it has set a foundation for modernizing payment services with strong consumer protection and payments security requirements in mind. The EU has further plans to adopt PSD3 in the future.

Its main areas of focus include:

- Promoting a more integrated and efficient EU payments ecosystem

- Creating a level playing field for both traditional and new payment service providers

- Strengthening payment security and reducing fraud

- Upgrading protection for consumers and businesses across the EU

If the business facilitates cross-border transactions within the EU, it must comply with PSD2. This principle applies to many regulations and global businesses operating in different markets.

🇺🇸 USA

The key regulatory players include the Federal Trade Commission (FTC) (regulates the payments system), the Federal Reserve System (helps ensure safe transactions), and the Consumer Financial Protection Bureau (CFPB) (enforces fair practices in the industry).

For example, the FTC’s Federal Trade Commission Act protects consumers and their payments by mandating businesses to:

- Inform consumers about their payment before they complete the transaction (for example, the total amount, any applicable fees, and refund policies).

- Secure payment information throughout the whole business relationship with the customer (for example, using tokenization, encryption, ID verification, or 2FA).

- Inform consumers about payment disputes (for example, provide a guide with instructions on how to resolve a dispute).

What Businesses Need to Follow Payments Compliance?

Key entities that must comply with payments compliance include payment providers, merchants and financial institutions. However, any company that stores and processes payments data (such as credit card details) and facilitates transactions needs to follow and align with payments compliance. Consequently, not only traditional financial institutions but also other various online platforms must comply with these regulations, regardless of their size or business type.

Other examples include:

- Businesses with recurring payments. For example, subscription service providers, utilities and telecom providers need to prioritize payments security.

- E-commerce businesses. Basically, any company that offers online services or items needs to have secure payment gateways and a strict compliance/fraud prevention program.

- Hospitality businesses. This includes restaurants, hotels, services like Airbnb, and similar establishments that need to be protected using POS systems.

- B2B companies. This includes businesses that handle payments from vendors, suppliers, and other partners and need to ensure secure transactions while following KYB requirements.

What is Anti-Money Laundering (AML) in the Context of Payments Compliance?

Anti-money laundering (AML) is a set of processes and policies set by regulatory authorities that focus on preventing financial crimes, such as money laundering or terrorism financing, which often happens when criminal organizations disguise dirty cash as legitimate financial assets. AML compliance is tightly linked to payments compliance due to the similar risks that both frameworks focus on.

Many high-risk regulated entities, such as fintechs, must comply with both AML and payments compliance requirements. While payments compliance focuses specifically on securing payment processes and protecting transaction data, AML is a broader framework that consists of various strategies to detect and prevent financial crime. So, payments compliance is a critical part of the larger fraud prevention approach defined by AML regulations.

Some of the AML measures that are vital for ensuring compliance and proper fraud prevention include:

1. Identity Verification

This involves KYC (for individuals) and KYB (for companies) verification to ensure that the entity and its related individuals are legitimate, don’t use forged documents, aren’t sanctioned, etc. The standard identity verification process consists of verifying different documents, for example, if it’s an individual customer, their ID document (passport, ID card or driver’s license) is required, often also paired with other documents, such as proof of address (PoA) to check if their residential address is legitimate by asking to upload a utility bill.

If it’s another company and a B2B case, documents like Articles of Organization are required, along with standard company details (name, address, etc.), and licensing is required. Additional verification steps are often performed as well, including validating the company’s Employer Identification Number (EIN) and confirming that the entity is in good standing with relevant authorities.

Related: KYB vs KYC — What is the Difference?

2. AML Screening

This is the process of screening customers against different AML databases to find potential matches. These checks typically include screening individuals against sanctions lists, politically exposed persons (PEPs), adverse media coverage, and global watchlists.

3. Risk Assessment

This is the process of assessing risks and evaluating a customer’s risk profile, then providing a score, low, medium, or high. For analysts and compliance officers, this helps proceed with enhanced due diligence (EDD) with high-risk cases that need extra due diligence measures and attention.

4. Transaction Monitoring

This process involves reviewing customer transactions and payments to detect anomalies that might have links to criminal activity and financial crime. Often, companies integrate some sort of AML automation solution to track and monitor transactions in real-time because it helps them stay compliant and detect risks more efficiently. For example, flagging transactions that deviate from expected norms or exceed predefined risk thresholds.

If suspicious activity during this process is detected, companies must submit a suspicious activity report (SAR) or other required documentation to the relevant authorities.

How to Ensure Payments Compliance?

Payments compliance isn’t a one-size-fits-all type of situation, as it consists of various regulations, including AML measures, ID verification, and ongoing due diligence. Importantly, compliance doesn’t end at onboarding. Risk profiles can change over time. That means even previously low-risk customers may become involved in suspicious activities or be exploited as money mules. That’s why ongoing monitoring is essential to detect and respond to any changes in customer behavior that may pose a compliance risk.

Still, certain steps can’t be missed, and to be compliant, companies must:

Aling Compliance Efforts with Relevant Payments Regulations

Universal rules, such as the PCI DSS framework, apply to all businesses handling cardholder data and serve as a base. However, businesses also need to assess which regional-specific regulations are applicable in their specific case.

To stay compliant, companies need to:

- Comply with laws like PCI DSS, AML and data protection regulations

- Built an internal AML and payments compliance strategy

- Use documentation, defined policies, incident response plans and report suspicious activity if needed

Companies need to consider whether future company expansion plans may require extra attention to new regulatory requirements. This is important, as payment compliance regulations are evolving, which means new standards are introduced each year.

Prioritize Both Security Controls and Customer Experience

Implement security and payment controls, such as multi-factor authentication and identity verification, before allowing users to transact on the platform. Check your compliance requirements and don’t overburden customers with unnecessary checks that can lower conversion rates.

To simplify and secure the user journey without disrupting their experience, make sure to:

- Provide support for chargebacks or unauthorized transactions

- Use encryption tools and security measures like 2FA or one-time passwords

- Offer multiple payment methods for better conversions

More importantly, it’s vital to be transparent and keep the customers informed about all fees, including payment processing or cancellation fees. Make the payment process easy to use and efficient to maintain user trust.

Use Automation to Respond to Evolving Threats

Most Trust and Safety teams use some sort of automated software to detect abnormal user behavior, for example, on marketplaces when there’s a breach of Terms and Conditions. The same goes for other security processes, such as identity verification. Using special AI-powered tools, companies can streamline asking the user to upload their identity document and conduct secure biometric checks to ensure they’re onboarding legitimate, genuine users. This also helps combat multi-accounting and other types of fraud that can happen after accepting a fraudulent user to a company’s network.

With automation, companies can:

- Build an efficient verification system that onboards merchants and customers fastly and securely, boosting revenue right from the start.

- Have an accurate risk assessment that is based on real-time risks and collected risk scores alongside mandatory checks like credit assessments that don’t slow down the onboarding.

- Enhance ongoing monitoring to detect changes in customer behavior or flag high-risk merchants that need to be reviewed manually or blocked altogether

So, automated payments compliance, fraud prevention and KYC/AML or KYB tools are vital in this sense because they help companies handle large transaction volumes and make monitoring more efficient. Analysts can respond to threats in real-time and report suspicious activity within the required time, in line with AML compliance requirements. Otherwise, without automation, analysts would have to spend hours reviewing each document or each transaction, which is simply not sustainable for a company that wants to scale or has a large user base.

Audit Your Payments Compliance Program

Internal and independent third-party reviews are necessary to keep your payments compliance strategy up-to-date. Independent auditors create an unbiased assessment and can bring insights after testing that help companies strengthen their overall compliance framework. That’s why regular reviews help detect the processes that need to be improved or changed.

This is a common practice for a company’s AML program as well, since fraud evolves and regulations change, and using outdated practices can lead to non-compliance. Standard security checks and simulations, such as phishing attempts, can also help assess how the company’s employees respond or handle such threats.

Ensure Payments Compliance with iDenfy

iDenfy’s fraud prevention software provides you with an end-to-end approach to regulatory compliance, with all the needed tools to protect your payments ecosystem and secure transactions.

This includes standard ID verification solutions, such as document and biometric checks, along with AML screening and monitoring tools for ongoing due diligence. Extra solutions include AI Risk Assessment and other age verification for age-restricted businesses, database cross-matching, and KYB tools for verifying corporate entities through checks like EIN/TIN verification, and more.

Let’s chat so you can find tailored solutions that ensure payment compliance and align with your specific use case.